|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding 2nd Mortgage Interest Rates in Today's MarketIn today's fluctuating financial landscape, understanding 2nd mortgage interest rates is crucial for homeowners considering leveraging their home's equity. A second mortgage can provide funds for major expenses, but the interest rates often vary significantly compared to primary mortgages. What is a Second Mortgage?A second mortgage is a loan taken out on a property that already has a mortgage. The loan is secured against the property's equity, which is the difference between the home's current market value and the remaining balance on the primary mortgage. Types of Second Mortgages

Factors Influencing 2nd Mortgage Interest RatesVarious factors can affect the interest rates on second mortgages, which generally tend to be higher than primary mortgage rates. Key factors include: Credit ScoreYour credit score plays a significant role in determining the interest rate. A higher score often results in more favorable rates. Loan-to-Value Ratio (LTV)The LTV ratio compares the loan amount to the appraised value of the property. A lower LTV ratio can lead to better interest rates. Current Economic ClimateEconomic conditions can impact mortgage rates broadly. For instance, comparing 15 year fixed rates today with historical rates can provide insight into current trends. Pros and Cons of Second Mortgages

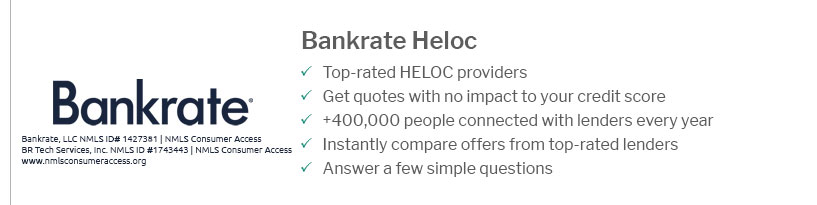

Exploring Alternatives to Second MortgagesFor some homeowners, exploring ways around getting a mortgage might be beneficial. These alternatives can include refinancing options or personal loans, each with its own set of advantages and drawbacks. FAQs about 2nd Mortgage Interest Rates

Understanding the intricacies of 2nd mortgage interest rates can empower homeowners to make informed financial decisions, balancing immediate cash needs with long-term financial stability. https://www.sccu.com/personal/home-equity-loans/fixed-rate-home-equity-loan

A fixed-rate home equity loan allows you to borrow against the equity you've built up in your home at a fixed interest rate and a consistent monthly payment for ... https://www.mortgagecalculator.org/mortgage-rates/2nd.php

Available APRs range from 6.60% - 14.15*, which includes the payment of a higher origination fee in exchange for a reduced interest rate, which is not available ... https://www.reddit.com/r/Mortgages/comments/1gb439p/do_second_home_mortgages_normally_have_higher/

Like ever D180+ is 1.00% (2nds) vs 1.53% (primary). More importantly the net loss rate is .0122% for primary and .0090% for second homes.

|

|---|